Award-Winning Dallas Attorney for Tax, Business & Real Estate Law — As Seen in Forbes

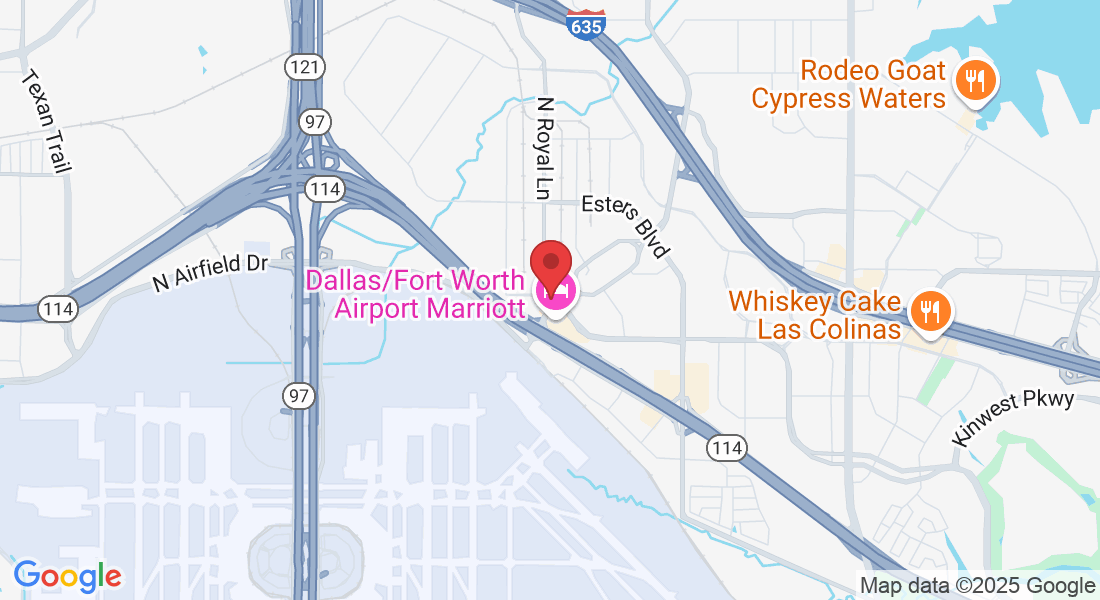

Schreimann & Associates, P.C. provides high-level legal counsel for IRS audits, business law, real estate, and estate planning matters across the Dallas–Fort Worth Metroplex. Led by Daniel W. Schreimann, an attorney and Certified Public Accountant, the firm delivers strategic solutions backed by decades of experience in both law and finance.

Featured in Forbes Magazine for refusing to extend an unreasonable IRS audit timeline — a stance that highlighted Schreimann’s commitment to protecting taxpayer rights.

Comprehensive Tax Legal Solutions for Individuals and Businesses

We help clients navigate IRS audits, tax compliance, penalties, and high-stakes disputes. Whether you're being audited, behind on taxes, or planning ahead, we protect your assets and minimize liabilities with precision and experience.

Built for Complex Tax Problems. Trusted by High-Stakes Clients

When your financial future is on the line, boilerplate advice won’t cut it. Schreimann & Associates is not a volume-based firm — we take on fewer cases to deliver deeper focus and more aggressive strategy. Whether you're facing IRS scrutiny, planning a business sale, or structuring a multi-generational estate plan, we bring high-level thinking, not just paperwork.

Why serious clients retain us:

35+ years in advanced tax, real estate & estate law

Dual credentials: Attorney + CPA insight

Custom-built strategies — not off-the-shelf plans

Court-tested representation for audits and disputes

Business owners, investors, and professionals trust our discretion

IRS Audit Defense That Works

If the IRS has contacted you, your next move matters. We defend clients facing audits by building aggressive strategies that protect your rights and financial stability. As an experianced attorney, Daniel Schreimann offers representation that understands both sides of the table..

Tax Disputes Resolved Efficiently

We negotiate and, when necessary, litigate to resolve disputes with the IRS or state agencies. From penalty relief to back tax settlements, our firm focuses on getting you the best outcome — fast.

Estate Planning That Preserves Wealth

We help clients create wills, trusts, and long-term asset protection plans. Whether you're planning for your family or managing a probate issue, we ensure your legacy is handled properly.

Business Tax Compliance You Can Trust

We work with LLCs, corporations, and partnerships to maintain proper filings, reduce audit risk, and navigate complex tax obligations — including international compliance when needed.

Testimonials

Jasmine Richards

Super helpful during my IRS audit and their estate planning advice was top-notch. Schreimann & Associates really eased my stress with their professionalism.

Monica Chandler

Explored several firms for estate planning and tax dispute resolution. Schreimann & Associates really stood out with their hands-on approach. Definitely a notch above the rest.

Thomas Krazinski

Handled our company's tax compliance with minimal fuss. It's reassuring to have Schreimann & Associates deal with the complexities so efficiently.

About Daniel W. Schreimann, CPA & Attorney at Law

Daniel W. Schreimann is an Attorney at Law and licensed in the State of Texas. With over 35 years in private practice, Mr. Schreimann brings deep expertise in taxation, real estate law, estate planning, corporate structuring, and permissible asset protection.

His legal focus includes tax planning and compliance for corporations, partnerships, and individuals; real estate title and transactions; estate and gift tax planning; wills, trusts, charitable planning, and probate matters; as well as corporate reorganizations, mergers, acquisitions, and buy-sell agreements.

Mr. Schreimann is also a long-standing fee attorney and the owner of several Texas-based specialty lending companies. These “hard money” lending firms focus on financing real estate purchases and renovations, purchasing discounted first-lien notes, and servicing real estate-backed loans across the state. One of his firms specializes in property tax lien lending, acquiring priority lien positions through the assignment of local taxing authorities' constitutional liens.

He is admitted to practice before the United States Tax Court and multiple federal district courts. Services are available in both English and Spanish.

In 1999, Mr. Schreimann was featured in Forbes Magazine for his principled stance during a high-profile IRS audit case.

FAQs

Your Tax Questions Answered by Expert Attorneys

What should I bring to my initial consultation with Schreimann & Associates?

Please bring relevant financial documents, recent tax returns, notices from tax authorities, and any related legal paperwork.

Can Schreimann & Associates help if I am already facing penalties from the IRS?

Yes. We regularly resolve wage garnishments, liens, penalties, and audit fallout.

Can Schreimann & Associates represent me in court for a tax dispute?

Yes, our experienced tax attorneys can represent clients in both federal and state courts.

What are the fees associated with your services?

Our fees depend on your case complexity. We provide a detailed estimate after an initial assessment.

How long does the process of tax dispute resolution generally take

The duration can vary greatly depending on the specifics of the case and the responsiveness of the involved parties. We strive to resolve disputes as efficiently as possible, but some cases may take several months to several years.

Do you serve businesses or just individuals?

Schreimann & Associates serves both individual clients and businesses across various industries, providing tailored tax solutions that meet the distinct needs of each client.